We all need a little help now and then. Whether it’s to finance a new house or start a small business, there’s no shame in pitching an idea for loan officers. On the other hand, there are definitely some loan requests that should probably never see the light of day.

#1 She’s in Sales

I remember this one time when one of my co-workers had a customer get approved for a business credit card. He then quickly used that to spend $10,000 on breast enhancement surgery for his wife. When we asked him how that purchase could even be considered a business expense he told us, "Well, she's in sales..."

#2 Totally Real Girl

I worked as a bank teller in college. My branch had a guy try to take out a $60,000 personal loan to help his girlfriend in Russia pay off border control. The money would allow her to finally join him in the U.S. after a two-year exclusively text-based relationship. No matter what we said, he remained firmly convinced that she existed and was in love with him. He also believed that the $30,000 he'd already sent "her" was money well spent. We didn't give him the loan. He closed his accounts on the spot, taking the entire <1,000 he had left with him.

#3 Used Truck

We had a guy come in wanting a car loan for a used diesel truck. The truck was $15K. Unfortunately, the truck had high milage and his credit wasn't the greatest. So, we could only approve him for $6,000 and 15% interest. It wasn’t a good loan and I told the customer as much. I advised finding a lower mileage, newer vehicle and waiting six months to repair minor credit issues in order to get a lower interest rate.

He insisted on getting that truck right that very moment. He proceeded to tap into his retirement funds. I’d imagine that he probably paid some insane penalties and taxes as well. He also paid the $9,000 down payment and signed the paperwork for the loan. Three months later, he had to sell the truck at a loss.

#4 Buying Property

I used to practice the art of personal loans. Someone wanted $10,000 to buy a ranch in Tennessee and we were in L.A. So, I asked him how he planned to buy a ranch in Tennessee with only $10K. He then ran away without a word. To this day, I still wonder what he really would have done with the $10K if I had given it to him.

#5 Soaring Temperatures

The saddest one I ever got was an 88-year-old woman who applied for a $100 loan to get a window AC unit for her trailer. She didn’t have a computer to apply online and wasn’t able to drive, so her daughter drove her to the branch. The temps were getting up to 104 that summer and it was dangerous for her to be inside. The unit was $60 but she was too frail to pick it up and needed the extra $40 to get it installed. We couldn’t approve her and I was a little upset about the daughter. She couldn’t save $40 for two months to help out her mom?

#6 Personal Loan

I handled a fraud case where the lady took out a $6000 personal loan in cash. She sent it to who she thought was an ‘80s-era country singer who claimed to be in financial trouble. She stuck the cash in an envelope and mailed it to another state. She also sent several thousand dollars worth of iTunes gift cards through the mail to him because somehow that would help him pay his bills or something. I think she spent close to $20K on him.

#7 Having a Baby

I work in 401(k) administration. You can take a loan out on your 401(k) depending on how the plan is set up. One of the provisions for many plans is that you can take a $5000 loan if you have a baby or adopt. Someone called in asking to take a loan because their friend had a baby. Um, what? No, we won't give you $5000 whenever someone you know has a child.

#8 Instagram Influencer

I had once had someone ask for $500 as an Instagram influencer to market his product. Fast forward to one month later. He then needed $5500 to pay his mortgage that he was behind on just because of some PayPal issues. Oh, he also needed $500 to pay an influencer because then he’d be rich. He had everything figured out, just needed a single legit Instagram post to set the plan in motion.

#9 Million-Dollar Idea

I’m not a banker, but I heard a co-worker at a previous job complaining to someone that his loan application for his "cigarette company" was denied. His logic was that he enjoyed rolling his own smokes, so why not start a business selling hand-rolled cigs? He legit thought he would make millions of dollars doing it.

Sign Up For Our Newsletter

Stories that matter — delivered straight to your inbox.

#10 No Longer Laughing

I once knew a friend of a friend (possibly of a friend) who wanted to start a coffee chain based on a fairly labor-intensive setup. I just laughed; I couldn’t help it. I was at his first coffee shop and I didn't think he produced an especially good cup of coffee. His coffee shop is called "Blue Bottle Coffee.” I’m no longer laughing.

#11 Questionable Renting

My banker told me a story of a rapper who asked for a loan to make his music video. He then produced an itemized list of the various items he’d be renting, including two kilos of blow. He’s usually not one for telling tall tales, but that just bordered the line between believable and not for me. The most surprising thing is the guy was planning on renting blow.

#12 A Close One

It’s not too crazy, but someone wanted a loan for an airplane. Not just a single-prop Cessna or anything like that, but this plane could seat ten people and had climate control and everything. My head underwriter didn't want me to use the plane itself as collateral. The reason being, “he could just take off with it and end up anywhere on the planet!" After explaining that was pretty much true with a car or boat loan too, she acquiesced. I'm not going to tell you for privacy’s sake how much it was, but let's say that I could have not sold another loan for about six months and still exceeded all of my goals.

#13 A Better Farm

I make Agriculture loans exclusively. So, we make no other loans except for farmers and ranchers. A borrower’s wife came, in her mid-40s, and asked to borrow $10K. But, she didn’t want her husband to know. I asked the purpose and she beat around, but finally told me she needs the money for a breast enhancement surgery.

I told her I could only make loans that “enhance the farm.” Then, she gave me this big spill about how it would increase her husband’s moral, therefore a better farm. It was still a hard no. Somehow, she got the procedure. Two years later, she had a nice new chest, a new husband, and together they own half of a cotton farm. I still bank the first husband.

#14 Sacrificing the Barn

I used to work in a department of Wells Fargo that specialized in the weird. We handled all the loans no other department would touch. It started as a way to keep business customers with lots of money happy. It was like a courtesy loan, knowing that we would make money from them elsewhere. One of the most iconic loans was where a farmer put up a barn as collateral to get a loan to buy his wife's dentures. They were approved and kept on the books until they paid it off.

#15 Going on Vacation

I don’t work as a banker, but I have a customer who received loan offers. I know that I don’t know much about it, but I find it bizarre that people take loans to go on vacation. Unless one of the travelers is losing their life or will never be able to travel in the future, borrowing money to go on vacation baffles me.

#16 Housing Implosion

We used to offer a home equity line of credit with the marketing along the lines of, "It's like turning your house into a savings account." It even came with a Visa card. It had a monthly adjustable variable rate tied to the prime rate. People applied for it like mad and that’s the most bizarre loan I have ever seen. I'm pretty confident they all lost their houses in the housing implosion a few years later. Home equity is a useful tool, but you know people were going on vacations and buying groceries with that card.

#17 Variety of Sources

I work in tech, specifically in the mortgage industry. The funniest thing I saw was a closing disclosure for someone who was paying off a ton of debt. It was from a variety of sources by refinancing their home. They had a section K (third party payoffs) that was literally longer than our document form could handle. Normally, this section can handle 10-11 payoffs and it's rare for us to see more than two or three. This person had close to 40, which is insane. It took our tech team three days to get a new template that would work, get it approved, and fix the software so it could be handled.

#18 Not All There

We once had this lady who wanted to draw down $100k to send to her “friend” in South Africa — who she never met. We kept declining the application and eventually had to get her son involved because she refused to believe she was getting scammed. I think he ended up trying to get POA on her accounts. She wasn't all there.

#19 First and Last

In 2007, my buddy was hired by a regular at his pub to become a mortgage underwriter. One of his first “customers” was a guy who made $1800 per month. He applied for a loan that had a monthly payment of $3600 per month to start, but it was an ARM and was slated to increase to $5400 per month after three years. This loan was to buy a boat, not a house. The guy who hired my buddy came in and told my buddy to underwrite the loan. And that’s the story of how my buddy quit his new job before his first shift even ended.

#20 Have to Cancel

My dad worked for Citifinancial way back. He told me how this guy took out a loan to buy a ring for his girlfriend of several months. He also wanted to buy her car and give her what was left over to help her out with her kids. That same guy came back a week later to cancel it because she took off with the car, money, and ring. She then ditched him and her kids.

#21 Unspecified Job

This happened some years ago now. A friend of mine who works as a loan officer had to explain to a guy that he couldn't get an additional loan to cover the down payment on a mortgage. The guy didn't have a job, but he kept insisting that he would be starting some unspecified job in three months. He didn't know how much it paid.

#22 Replacement Bees

I have a friend who’s a farmer and beekeeper. He lost 60% of his hives to CCD, so he was forced to go to his banker and ask for a $1 million loan to buy replacement bees. A bee passes away in 30 days. Regardless, he made it work and is still in business. But, the thought of that debt obligation makes me pucker every time I think about it. A million dollar loan… for insects with a 30-day lifespan.

#23 Not Good for It

I'm in the back office for reporting bad loans to our stakeholders. We acquired a bank that gave a farmer $5 million and only had his cows as collateral. He stopped paying the loan, we went to go pick up the cows and they were mysteriously gone. The board of directors wasn’t happy but it was very obvious why the bank we bought was going under. I’ve also seen insane collateral stories from junk banks we've bought in the past. Just because they lend, doesn't mean they're good for it.

#24 Trying to Invest

This loan was only bizarre because it was incredibly stupid. If I remember correctly, one time this guy wanted to borrow around $20K to buy bitcoin. I had to talk to a manager afterwards to make sure they knew that it was reasonable for me to decline it based on the "no loans for investments" rule. It was indeed.

#25 What’s Your Plan?

I used to process subprime loans back in the late ‘90s. I once had a borrower do a debt consolidation loan with the equity they had in their house. They were also getting cash-out. The underwriter asked for a Letter of Explanation - basically, what are you planning to do with all this money? The borrower wrote back that they planned to buy a new yellow Ford Ranger XLT and attached a PO from their dealer. The loan rate was north of 10% for 30 years. They got their cash-out.

#26 Vintage Vehicle

A gentleman came into my small local credit union to apply for a car loan. I asked, “Great, what kind of car is it?” He told me a jeep, so I said, “Awesome! What's the exact model?” Then he started stumbling. "Uh, it's custom." I asked the year and he said 1989. I commented on how that was an older model, so I asked the mileage. "Not sure, the guy I'm buying it from is in [different state]."

At that point, I said, “Oh, I'm sorry. It would have to be registered in-state.” Then he just said, "Oh. Well do you know how to register a monster truck with the DMV?" After seeing my reaction he went, "Yeah, the Jeep's been converted to a monster truck. I'm not just gonna drive it around." I just had to apologize and tell him we wouldn’t be able to finance his… out-of-state, vintage, monster truck.

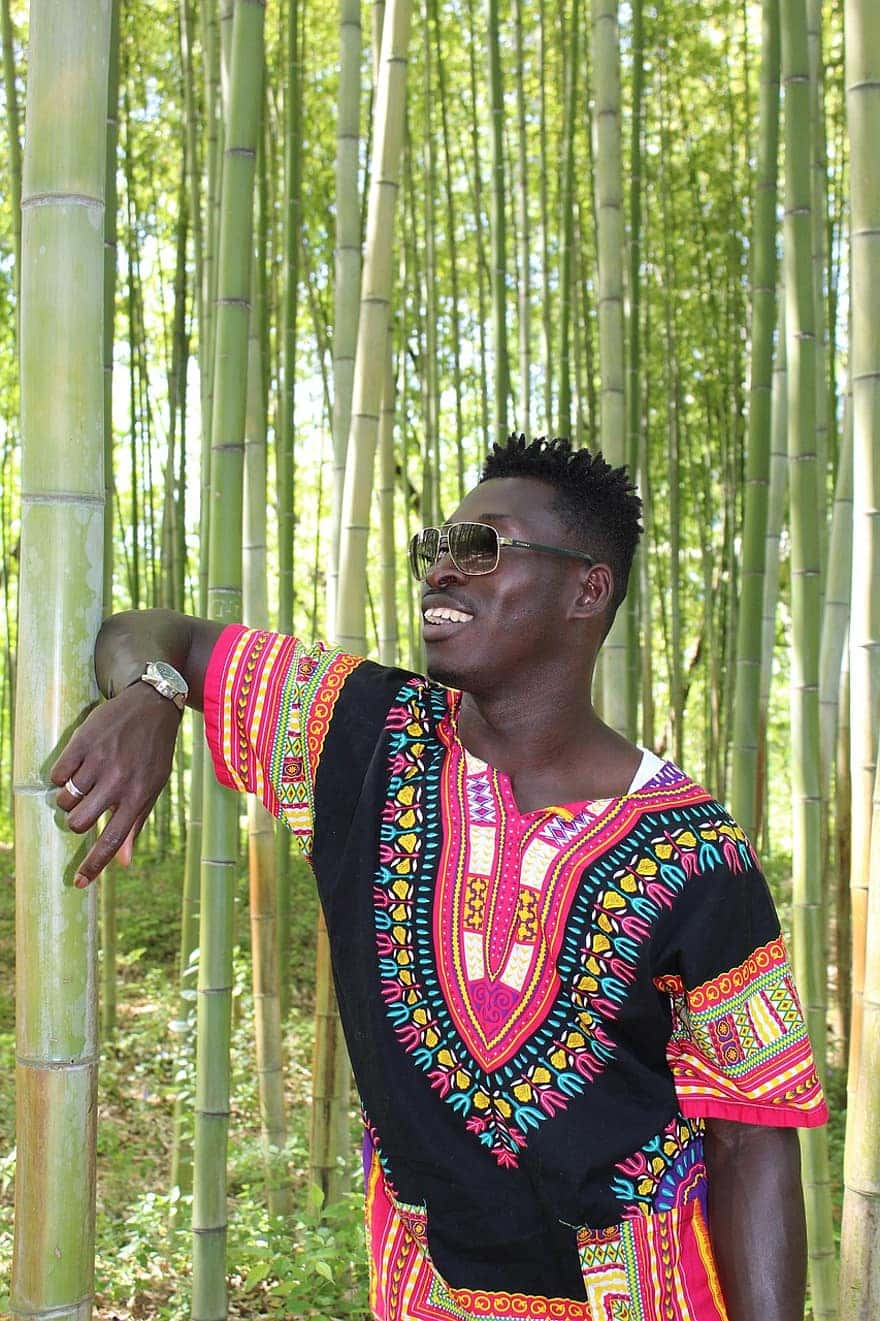

#27 Making Up the Difference

One time, this African dude wearing a dashiki came into the branch and sat with a female co-worker of mine. He was a super loud talker, his conversational tone was borderline yelling. He told my co-worker that he wanted to file a fraud claim, so she connected him with the department over the phone at her desk.

This guy’s claim was he got a lady of the evening yesterday and owed her $100 bucks. But, he didn’t have cash handy and was too lazy to hit the ATM. His solution was to give her his debit card and PIN and have her go to the ATM. Surprisingly, she never came back and withdrew $300 instead of the agreed-upon $100. He wanted to file a claim for the $200 difference.

#28 Top Three

I used to work at a bank assessing claims for hardship. One customer accumulated $15K credit card debt playing Farmville (this was about eight years ago). We had another who just turned 18. They had a credit card with a $5K debt in one month from games and Dominoes purchases. Another middle-aged gentleman maxed-out two $75K credit cards on “an internet dating service.” His transaction history showed that it was spent on webcam girls.

#29 Feeling Sorry

A guy requested a loan for $129,000,000 USD to build a luxury hotel he'd designed himself. He created all the 3D images and everything. He had a business plan that showed ridiculous profits in the first year after opening, they were as unrealistic as you can imagine. Then, he was very upset that we rejected him and said that the bank was never going to fund it.

Later I was told that he used to be a university professor in our country but then had some kind of a breakdown. Apparently, he was living with his mom (he was in his 40s). He was coming for the third time with a ridiculous plan and seemed to be on the hunt for the "one true money maker." It was hard not to feel sorry for the guy.

#30 Second Loan

I had a man apply for an auto loan. When I pulled his credit, I asked where the Ford on his credit was. He promptly told me he dropped it off at the dealership across the road and let them repo it about five minutes ago. He then said that he now wanted something else. He even pointed it out through the window. I guess he figured he could get a second loan before the banks saw he repoed it.

#31 Losing Money

I had a customer ask for a $25K loan. He wanted to invest with the bank in our managed funds so that he could then use the profits as a house deposit. He couldn’t understand that because the interest rate on the loan was 10% p.a. more than the interest earned on the managed funds, he’d actually be losing money.

#32 An Awkward Situation

I’m a mortgage banker and I work in a call center. All loan applications are done over the phone. One day, I had this lady who was in her mid-60s with an extremely raspy voice. She proceeded to tell me how hot she was and needed to have relations since she was no longer attracted to her much older husband. Needless to say, it was awkward and I tried to get her off the phone as soon as possible. Many other times, I’ve had a spouse trying to get a cash-out to refinance without the other knowing.

#33 Evasive Answers

My wife works as a banker. This one time, she had a woman come in looking for about $150,000 to build an app that would “change the world.” After giving some pretty evasive answers onto what kind of app it would be, she finally said, “No, no. The money is to learn how to make an app that would change the world.”

#34 Unusual Loans

I’m not a banker, but something I saw in an article a year or two ago about this. The article was detailing the most unusual loan reasons in my city. The ones that I still remember were to buy a Maine coon cat ($2000 at that time, I think), historical books and arranging a marriage for an ex-wife. It can get crazy.

#35 Wakeup Call

My college roommate was always spending insane amounts of money on stuff. One week, he had a new TV and a PS4. The next it was a car and the next some other overly-priced, unneeded thing. It was insane. I asked him where’d he get all his money he said it was from his loans. I assumed it was a bit extra that he got in a school refund when you overpay your school bill with your loans. Nope. He literally took out a loan to buy this stuff. I had to explain to him that you have to pay it back, it’s not just free money. That was a real wakeup call for him.

#36 Small Debts

We had an application from somebody once who wanted to borrow from us so he could pay administrators to help him file bankruptcy. To this day, I don’t really know what he was thinking or hoping for. I mean, I guess he didn't think we would see through his clever plan to get money out of us. Obviously, we did.

We also often have people apply for loans for debt consolidation of a single debt when they have quite a few others in arrears. When we query the single debt, it's the only one with a guarantor. So effectively, they want us to lend them money to remove the security on that one debt so that they can then treat us like the rest of their creditors, or apply for an insolvency action to try and help them reset their credit.

#37 Please Leave

I was working in my bank and three guys come in asking for $250K to buy gasoline. They had these really weird charts with big-chested women to show their forecasted rise in the price of gasoline. I’m pretty sure they made it all up. The strangest moment came when I rejected their loan. They offered to take me into the back and have relations with me. Needless to say, I asked them to leave.

#38 A Down Payment

One that stood out was a single man in his 30s with no job, using social security benefits and disability income to qualify. In total, his monthly income was less than $2K. I thought that was odd, so I looked at the numbers proposed for his loan. The mortgage plus interest would take up more than 50% of his fixed income on this home he wanted to buy in Wisconsin. He was getting down payment assistance. However, I questioned why he was doing this when he clearly wouldn't have enough expendable income to live, buy daily necessities or save for emergencies. I'm not sure if he was ever fully approved.

#39 On the Down Low

Former Sallie Mae employee here. The number of teenagers applying for loans solely to buy $30K BMWs was insane. Many would call in for community college loans that were about $2k a semester but wanted the extra money to live well above their means. I don’t think I saw anyone ever get approved as they applied for these with no cosigner to hide the extra money from their parents.

#40 Gourmet Beans

I once met with a landlord to look at a two-bedroom apartment he had for lease. When I showed up, he was with a woman who was looking at leasing out the storefront on the ground floor of the building. Apparently, she wanted to start her own gourmet jellybean business. She said she already had her loan from the bank and was looking to open immediately. After she left, the landlord and I had a laugh about it and discussed how doomed her jellybean store would be. This was in 2008.

#41 The Final Car

I financed and traded in three new cars back-to-back. I ended up with a car loan three times the value of the final car. I know this because when I totaled the third car, the bank let me know what the price actually was. Thank goodness for GAP insurance because insurance had to eat the negative equity of $40K.

#42 A Sound Investment

I did financial statements for people in debt. This guy couldn’t pay his debts and I had to put together a statement of what he earned and spent. Having done it all, I couldn't find what was happening to $500 a month. Eventually, I found out it was going to his Nigerian girlfriend, who he never met, to fund their development of a gold mine. Her father discovered it while planting bananas. He was convinced this was a sound investment.

#43 Travel the Country

I work as a broker. A few years back, I had an unemployed lady ask for a $50,000 unsecured loan because she and her daughter had become intolerant to the 21st century. They decided to travel the country until they found a space that they could tolerate. They’d then find a job and pay the money back. So no fixed abode, no job, no assets and no forecast of how or when to repay. I didn’t progress any further than that.

#44 A Small Loan

I had a young guy once come in for a small loan. He was 18 and was working for merely six months. However, he was qualified for a loan about two days after he applied for one. He took $8K in loans for a vacation and an RC car. I actually asked my manager if I had to give him the loan if he was qualified for it. He said yes.

#45 Sorry Every Time

I had some clients who wanted a loan once in a while because they didn’t have a job and no money in their bank account. They were desperate and really needed money for food. I felt sorry every time because I had to refuse those. I also had a 30-year-old guy with no money or a car who wanted a loan for a quad. He went crazy after I refused and nearly had to call the authorities.

#46 Finished Paperwork

I had a customer come on for a personal loan. He wanted $6000, which isn’t too much, but enough that he could benefit from adding collateral. I asked if he wanted to secure anything to the loan to make the interest rate lower, he was at 20% with no credit history. When I asked, he said that he only had a vehicle in his name but it was an 04 Audi A4.

Needless to say, a bank doesn’t want that for collateral. After I informed him of the requirements, he said, “It’s okay. The loan is to repair the vehicle.” He had cut his springs and sent a coil-over through his quarter panel. He wanted the loan to get an airbag suspension for the vehicle. We never even finished the paperwork.

#47 Clearing That Up

I used to work as a bank teller back in the day. One day, a guy called and I answered the phone. He said, “Yeah, I need a loan.” I asked him what type of loan he was interested in so I could direct his call to the right person. He then responded with, “Uh, a money loan!” Okay then. Thanks a million for clearing that up.

#48 The World is Ending

I have a former co-worker who thought the world was going to end in 12.21.12. He told us that he knew of a location where people could survive the apocalypse. Apparently, he needed a boat to transport him and his family to said location. He ended up going to the bank for a loan for the boat and told them why he needed it. He wasn’t approved, but fortunately, the world didn’t end either.

#49 Changing His Mind

It’s always really weird lending to churches. I heard a story from a colleague who was trying to get a loan for a church that didn’t have the collateral to support it. When the banker went in to deliver the bad news, the elders of the church circled around him to pray over him. It was as if that was going to change their mind about giving the church the loan.

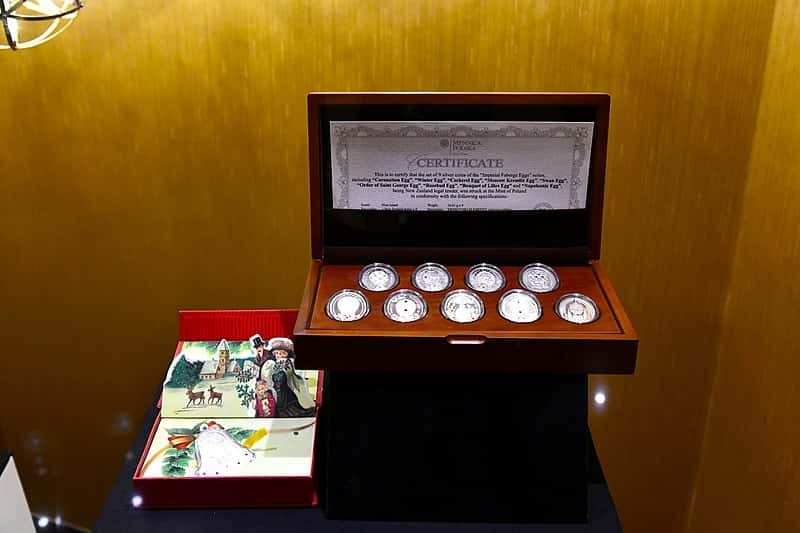

#50 Here’s My Certificate

When I was a mortgage originator, I remember some old lady wanting to refinance her home, but her only income was social security. She said she wanted to claim other assets, so we asked her to fill out a form for them. We were expecting something like annuities or art. Her collateral was a certificate of ownership of one humpback whale and a collection of dubiously dated Roman coins. She was denied.